967

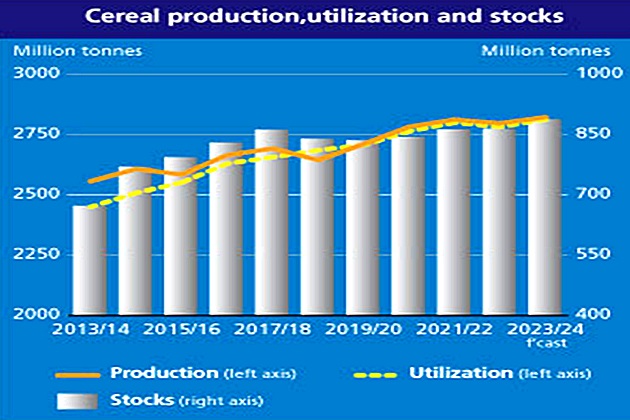

Forecast FAO for the global cereal production in 2023 has been revised upwards by 13.2 million tons (0.5 percent) this month and is expected to reach a record of 2,836 million tons. This represents a growth of 1.2 percent (33.3 million tons) compared to the 2022 level.

Increasing Productions

The revision is primarily the result of better-than-anticipated corn productions in several key producing countries, while modest upward revisions have been made to global barley and wheat production forecasts.

Global coarse grain production is set at a historic high of 1,523 million tons, following an upward adjustment of 12 million tons this month. Most of the revision reflects new official data from Canada, China (mainland), Turkey, and the United States, where a combination of higher yields and larger harvested areas than previously expected led to higher corn production estimates.

Global barley production also increased, changes mainly concentrated in Canada and the Russian Federation, while global wheat production increased by 1.4 million tons and now stands at 788.5 million tons in 2023, although still 2.2 percent lower year-on-year.

Improved production prospects this month are mainly driven by Canada's wheat yield and harvested area, which exceed previous estimates, offsetting more than a reduction in Brazil's wheat forecast due to the effects of heatwaves and excessive precipitation.

Regarding rice, the estimated production for China (mainland) has been reduced since December, as official assessments indicate that planting reductions in major producing provinces in the northeast were more pronounced than previously anticipated by FAO.

However, this revision is largely offset by production improvements for several other countries, notably Nepal, where a record harvest is reported despite meteorological whims, and Mali and Guinea, due to pronounced expansions of the area.

As a result, FAO's forecast for global rice production in 2023/24 is now at 524.6 million tons (milled basis), marginally lower than the December forecast but still 0.6 percent above the 2022/23 result.

Looking to 2024, global winter wheat sowings are expected to contract moderately year-on-year due to lower international prices. In the United States, lower prices have led to a 6 percent decrease in winter wheat plantings.

Delays in the European Union

However, early drought conditions affect a significantly smaller area of winter wheat crop than in 2023 and may lead to a lower abandonment rate than last year. In the European Union, seeding delays caused by heavy rains contributed to a slight reduction in the winter wheat area.

A cold period in the Baltic Sea region in December caused some frost damage, while precipitation deficits continued in southern Spain and some parts of Italy. In Ukraine, the effects of the war have kept production prices low and input costs high, reducing profitability and liquidity, which could lead to further declines in wheat plantings in 2024.

In the Russian Federation, although most winter wheat crops are in good condition, abnormal warm weather in key wheat-producing districts, followed by a sharp temperature drop without sufficient snow cover, could cause localized frost damage.

In India, favorable weather and remunerative prices have led to an increase in the wheat area in 2024. Similarly, nearly record internal prices in Pakistan have led to increased wheat plantings and, with adequate availability of water reserves for irrigation, wheat production prospects in 2024 are largely favorable.

In China (mainland), the wheat cultivated area is estimated to be above the average of the last five years, supported by strong domestic demand and an increase in the minimum purchase price.

In the southern hemisphere, most coarse grain crops in 2024 are expected to be harvested from the second quarter of the year. In Brazil, excessive rainfall in southern parts and drought and high temperatures elsewhere have negatively affected plantings and the yield potential of the first season (minor) corn crop.

However, Brazil is expected to harvest an above-average corn crop in 2024, although lower than the historic high in 2023. In Argentina, as a result of the drought-affected harvest in 2023, corn production is expected to rebound in 2024, supported by above-average plantings and generally favorable weather conditions.

In South Africa, early estimates indicate a small expansion in 2024 corn plantings, partially at the expense of soybeans, as farmers rotate crops. While precipitation conditions at the beginning of the season have been largely favorable, there remains some uncertainty about production potential, reflecting forecasts of lower precipitation and higher temperatures in the coming months.

Growing Forecast

FAO's forecast for global cereal use in 2023/24 has been increased by 8.9 million tons since December to 2,822 million tons, surpassing the 2022/23 level by 1.2 percent (34.5 million tons). Now at 794 million tons, FAO's forecast for total wheat use in 2023/24 has been increased by 2.9 million tons since December and indicates an increase of 2.0 percent (15.4 million tons) compared to 2022/23.

The revision reflects higher-than-previously-anticipated use, especially in the European Union, as well as in Australia and the United States. Total use of coarse grains in 2023/24 is also forecast to increase by 1.3 percent (19.5 million tons) above the 2022/23 level, reaching 1,505 million tons, up 5.4 million tons from the December report. Higher-than-anticipated feed use of corn and barley, especially in China, is the main driver behind this month's upward revision.

Global rice use in 2023/24 is estimated to remain close to the 2022/23 level, at 522.2 million tons, despite an upward revision of 0.6 million tons since December, as a population-driven expansion of rice food intake is expected to be offset by cuts in other end uses.

Higher Stocks

FAO's latest forecasts for global cereal stocks at the end of the 2024 season stand at 895 million tons, up 8.9 million tons from December and 2.6 percent (23.0 million tons) higher than opening levels. The ratio of global cereal stocks to use in 2023/24 is forecast at a comfortable level of 31.1 percent, exceeding the 2022/23 level of 30.9 percent.

This month's revision mainly comes from an upward adjustment of 9.4 million tons to coarse grain stocks, which increased the forecast to 377 million tons, representing a 6.9 percent increase (24.4 million tons) over opening levels. While an increase in corn stocks (especially in China and Mexico) accounts for the bulk of this month's upward revision, barley and sorghum stocks have also been revised upward.

At 320 million tons, the forecast for global wheat stocks is almost unchanged from December and still indicates a 1.1 percent decrease (3.5 million tons) below opening levels. This month's upward revisions in stocks in Argentina, Australia, and the Russian Federation have offset downward revisions made for Ukraine, the European Union, and the United States.

World rice stocks at the end of the 2023/24 marketing years are now set at 198.8 million tons, down 0.9 million tons from the December forecast but still 1.1 percent above the estimated 2022/23 level.

Following an upward revision of 11.5 million tons from December, world cereal trade in 2023/24 is now estimated to increase from the 2022/23 level by 0.8 percent (3.7 million tons), reaching 480 million tons.

World wheat trade in 2023/24 (July/June), estimated at 197 million tons, is still scheduled to contract by 1.3 percent (2.5 million tons) from 2022/23, despite an upward revision of 3.4 million tons, largely reflecting improved export prospects for Ukraine and broader stronger demand from multiple importers.

World coarse grain trade in 2023/24 (July/June) increased by 8.9 million tons from December to 231.0 million tons, up 3.3 percent (7.5 million tons) from the 2022/23 level.

Larger-than-expected corn exports from Turkey, Ukraine, and the Russian Federation, together with stronger demand from China and, to a lesser extent, Mexico, contributed to an upward revision of 5.6 million tons in the global corn trade forecast, now set at 1.8 percent above the 2022/23 level.

The forecast for global barley trade has also been increased by 3.0 million tons due to larger sales from the Russian Federation and stronger demand from China.

The forecast for international rice trade in 2024 (January-December) has been reduced by 0.8 million tons to 51.5 million tons, largely reflecting less dynamic import expectations for Nepal and Nigeria and implying a 2.3 percent decrease from the already reduced 2023 level.